Momentum Media's mortgage brand, Mortgage Business, recently recorded an exclusive interview with Vernon Spencer, the ‘father’ of Australian RMBS, to discuss how securitisation was brought to these shores.

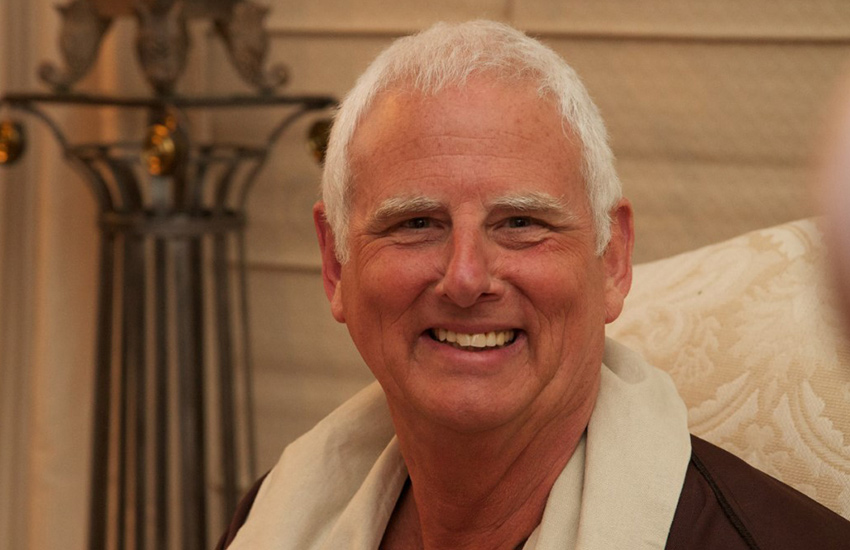

Vernon Spencer, executive chairman, Stargate Corporation Group.

In the captivating interview for the Mortgage & Finance Leader podcast, hosted by Annie Kane, the executive chairman of the Stargate Corporation Group revealed how he played a pivotal role in introducing Residential Mortgage Backed Securities (RMBS) to the Australian mortgage market.

Mr Spencer's journey began when he travelled to the United States to learn about the mortgage market there. During his time in the US, he was inspired by the mortgage pass-throughs issued by Ginnie Mae, Freddie Mac, and Fannie Mae. These government-sponsored enterprises were guaranteeing and trading mortgages, rather than holding them on their own balance sheets.

In conversation with Mortgage Business, Mr Spencer said he was particularly intrigued by the high yields of Ginnie Mae's offerings and saw an opportunity to bring mortgage-backed certificates to Australia. However, the main obstacle he faced was the extensive paperwork required for trading mortgages, which posed a significant barrier to securitisation.

To overcome this challenge, his company, Central Mortgage Registry of Australia, collaborated with legal experts, stamp duty specialists, and trustees to streamline the process. They devised a system where multiple mortgages could be packaged into a single certificate, simplifying the trading process. These certificates, known as Annie Mae, held a mortgage insurance policy from the Housing Loans Insurance Corporation (HLIC), a government-owned entity that provided Lenders' Mortgage Insurance (LMI).

With each loan backed by mortgage insurance, investors were drawn to this new instrument. His group then began pooling mortgages and issuing certificates from these pools, rather than issuing individual mortgage-backed certificates. This marked the birth of residential mortgage-backed securities in Australia, with the first RMBS being issued a year later.

Mr Spencer says he believes that these securities offered the best yield instrument available at the time, but he admitted that it took a while for others to understand the concept and replicate it.

After selling Central Mortgage Registry of Australia to Prudential in the 1980s, Spencer went on to establish Interstar Securities. Leveraging strategic funding and warehousing partnerships with prominent capital markets firms, Interstar Securities expanded its securitisation business and played a crucial role in developing a secondary mortgage market in Australia. The Interstar Securities Group eventually became one of the country's largest non-bank wholesale loan financiers. They funded their operations by issuing mortgage-backed securities to major institutions and investors in Australia. Additionally, the company provided training and support to brokers while tailoring their securitisation activities to suit institutional investors' needs.

In 2001, Prudential acquired Interstar Securities, which had grown to employ approximately 220 staff and had a book value of around $20 billion.

His pioneering efforts in introducing securitisation to the Australian mortgage market have had a lasting impact, shaping the industry and providing investors with a lucrative yield instrument.

You can listen to the full Mortgage and Finance Leader episode with Vernon Spencer here: